Washington, D.C. – A significant clean energy loan guarantee program by the U.S. government has been pulled amid a wave of political infighting, economic concerns, and shifting federal priorities — a development that is sending shockwaves through the renewable energy industry at a time when climate policy is under global scrutiny.

The decision to withdraw the federal backing for a multi-billion-dollar clean energy initiative — originally structured to support advanced solar, wind, and battery storage projects — is raising serious questions about the stability of long-term green investment in the United States.

Background: A Pillar of Green Energy Funding

The clean energy loan guarantee program, overseen by the Department of Energy’s Loan Programs Office (LPO), has historically provided financial assurances to companies pioneering breakthrough clean technologies. These guarantees are critical, particularly for early-stage projects that lack access to private capital due to high perceived risks.

Established under the Energy Policy Act of 2005 and bolstered during the Obama administration, the program has supported success stories like Tesla’s early Gigafactory developments. More recently, it was poised to finance large-scale initiatives including community solar grids and next-gen battery systems in states like California, Nevada, and Utah.

But this week, in a move described as “sudden and chilling” by industry observers, federal officials confirmed that the clean energy loan guarantee was pulled amid internal disputes, signaling a halt to what would have been one of the largest clean energy commitments in recent years.

💬 Why the Loan Guarantee Was Pulled

Several congressional sources, speaking on background, pointed to increased scrutiny from fiscal conservatives over the program’s risk exposure and cost-benefit justification.

“There’s real concern that these guarantees shift financial risk from corporations to taxpayers,” said one House committee staffer. “Pulling this loan package was part of a broader effort to rein in discretionary green spending.”

The decision also comes just weeks before the U.S. is scheduled to resume high-stakes U.S.–EU trade negotiations, where environmental subsidies have become a flashpoint issue. Analysts speculate that the timing may be a diplomatic move designed to appease critics accusing the U.S. of unfair trade advantages in the clean tech sector.

📉 Industry Reaction: Shock and Setbacks

Companies operating in the western United States, many of which had planned expansion based on anticipated federal guarantees, are now scrambling. In Utah, firms like Revo Technologies, which specialize in high-efficiency battery systems and microgrid architecture, have voiced concerns about how the move could derail growth.

“The loan guarantee was not just symbolic — it was foundational,” said a Revo executive. “Its absence creates a ripple effect on our private financing and R&D timelines.”

In fact, many startups and mid-sized clean energy companies had timed their scaling strategies to align with the loan’s disbursement schedule in 2025. Now, those plans are in limbo, with some firms reportedly considering layoffs or delays in project deployment.

⚠️ Implications for Climate Goals

The Biden administration’s climate platform has heavily emphasized achieving net-zero emissions by 2050. The withdrawal of federal support casts doubt on the feasibility of that timeline — particularly as utility-scale projects that rely on long-term investment begin to stall.

“It’s not just about pulling one loan,” warned Dr. Melissa Grant, an environmental policy professor at Georgetown University. “It’s about undermining a mechanism the government has used for nearly two decades to catalyze innovation.”

According to Grant, the optics of the decision could weaken America’s credibility at upcoming international climate summits and embolden political factions that are hostile to environmental regulation.

🧠 A Trust Deficit in Government Incentives

Entrepreneurs, state energy boards, and even some utility providers are now voicing concerns about the “trust gap” growing between the federal government and the private sector.

“There’s an expectation of policy stability when you’re making 10- or 20-year investment decisions,” said Ken Foley, an economist who advises clean energy funds. “Pulling this loan guarantee amid such high expectations creates a long-term chilling effect.”

Several energy developers are now reworking their financial forecasts to rely less on federal backing, but that often means higher borrowing costs — and less competitive energy prices for consumers.

⚖️ A Wider Pattern of Regulatory Reversals?

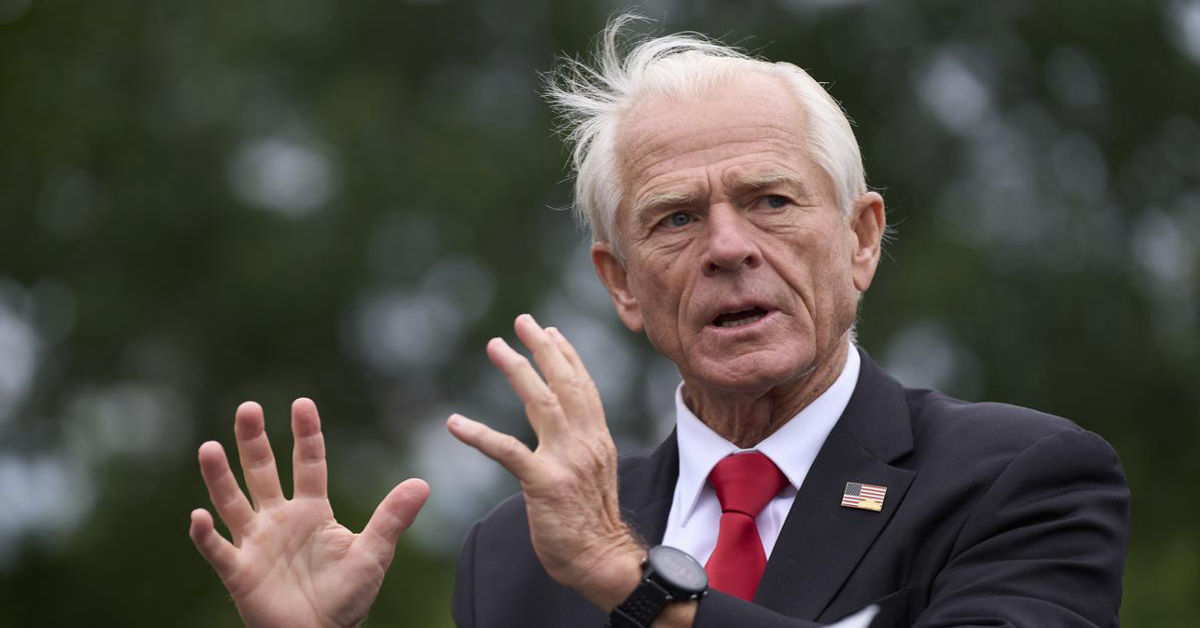

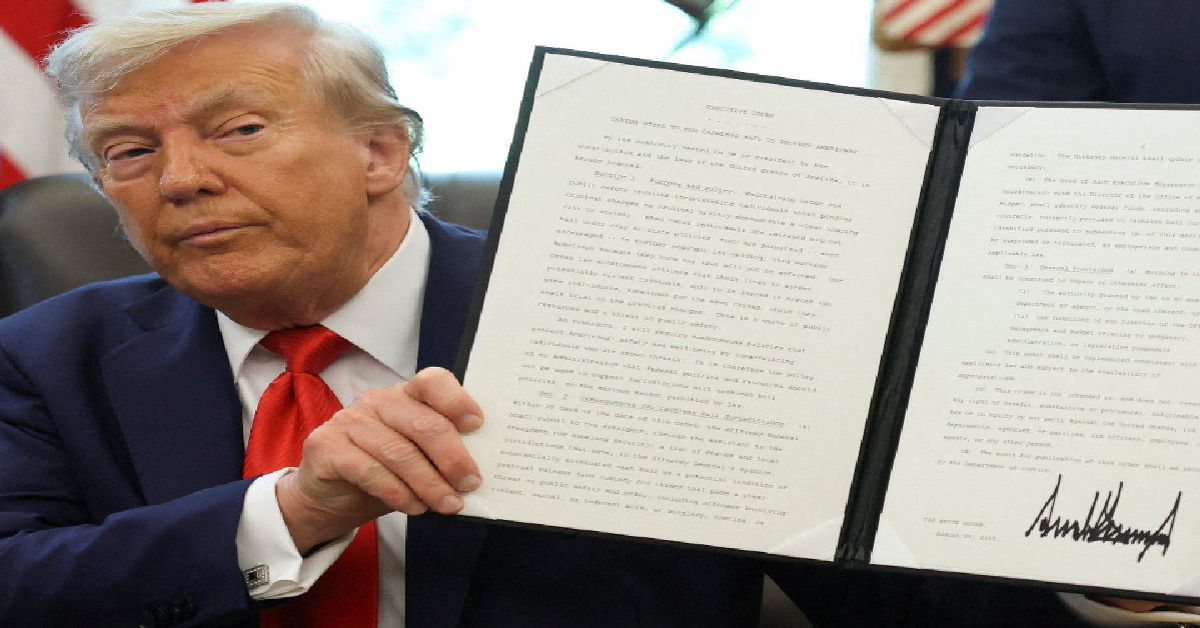

This is not the first time the energy or regulatory space has faced such abrupt shifts. Observers have drawn parallels to the Trump administration’s move to block the reinstatement of an FTC commissioner, signaling how agency-level policy reversals can cascade across industries.

“If administrative decisions can change overnight, it undermines the legitimacy of the programs themselves,” said Foley. “And in clean energy, where upfront costs are enormous, consistency is everything.”

🔮 What Comes Next?

As of now, there’s no clear path forward. Insiders say the Department of Energy may restructure the loan terms or create a scaled-down version of the guarantee, but nothing is confirmed. Meanwhile, lobbying efforts from state governors and clean tech coalitions are intensifying behind the scenes.

“There’s too much at stake here,” said one energy lobbyist. “We cannot afford to let politics derail the transition to a cleaner economy.”

Some in the clean tech space are cautiously optimistic that public backlash and market pressure may force a course correction in the coming months.

Conclusion

The sudden withdrawal of the clean energy loan guarantee has introduced a wave of uncertainty in an already volatile energy sector. As the U.S. races against time to meet its climate commitments, moves like this undermine both market stability and public trust. Startups and green tech innovators relying on federal backing now face stalled projects, financial disruptions, and operational setbacks.

Political infighting and regulatory unpredictability are becoming major barriers to progress. This decision not only affects funding but also signals inconsistency in America’s clean energy vision. Investors are growing wary, and state-level projects may be put on hold. Without a reliable federal framework, the private sector alone may struggle to deliver sustainable change at scale.

The ripple effect from this policy reversal will likely impact employment, innovation, and emissions targets nationwide. If not corrected soon, this could represent a major step backward in the global clean energy race. Only time will tell whether political leaders can restore confidence and get a clean energy policy back on track.

FAQs

1. What is a clean energy loan guarantee?

A clean energy loan guarantee is a federal commitment to back loans for renewable energy projects, reducing the financial risk for private investors. These guarantees are especially important for startups or large-scale projects that need significant capital to deploy new technologies. The U.S. Department of Energy typically oversees these programs through its Loan Programs Office. When functioning properly, they help drive innovation, create jobs, and accelerate the shift toward clean energy.

2. Why was the clean energy loan guarantee pulled?

The clean energy loan guarantee was pulled amid political pressure, budget scrutiny, and internal disagreements over financial risk. Lawmakers have raised concerns about taxpayer exposure and program transparency, especially as election season approaches. Some experts also believe the move may be tied to broader international trade negotiations. Overall, the decision reflects rising tension between climate commitments and fiscal conservatism.

3. How does pulling the loan guarantee affect clean energy companies?

The withdrawal significantly disrupts funding strategies for companies planning or scaling clean energy projects. Many firms, especially small to mid-sized startups, rely on these guarantees to attract private capital. Without federal support, borrowing costs rise, timelines are delayed, and in some cases, projects may be canceled. This can reduce innovation and slow the industry’s overall growth.

4. Which sectors will be most affected by this policy change?

The solar, wind, and battery storage sectors will feel the impact most directly. These industries often depend on large-scale infrastructure investments that are hard to fund without federal guarantees. Community microgrids, energy storage systems, and next-generation renewable tech could also suffer setbacks. States investing in green energy workforce development may also face job-related challenges.

5. How does this affect America’s climate goals?

Pulling the clean energy loan guarantee makes it more difficult for the U.S. to reach its net-zero emissions goals by 2050. Large-scale renewable projects are crucial for transitioning away from fossil fuels. When these projects are delayed or abandoned, the overall timeline for reducing carbon emissions is extended. It also undermines the government’s credibility in international climate discussions.

6. Will the loan guarantee be reinstated?

There is currently no official confirmation that the guarantee will be reinstated, though industry lobbying is ongoing. Some analysts believe the Department of Energy may restructure the program or reintroduce it with tighter risk controls. If public backlash continues to grow, there may be political pressure to restore funding. However, such processes could take months or longer, depending on federal priorities.

7. How can companies respond to this setback?

Clean energy firms can explore alternative financing through private equity, venture capital, or green bonds. Building partnerships with state governments or municipalities may also offer localized funding options. Additionally, firms can consider scaling down project size temporarily while maintaining innovation pipelines. Diversifying revenue streams and remaining agile will be critical in navigating this uncertainty.

8. What are the political implications of the loan guarantee reversal?

The move has exposed deep divisions in Washington over climate policy and public spending. Republicans argue for fiscal responsibility, while Democrats see it as a blow to clean energy progress. This tug-of-war may influence the 2024–2025 policy landscape and broader energy legislation. It also places climate-related spending under the microscope ahead of upcoming elections and trade negotiations.

9. How do loan guarantees differ from direct grants?

Loan guarantees reduce risk for lenders but do not provide direct money to companies, unlike grants. Instead, the government promises to repay part of the loan if the borrower defaults. This enables private lenders to offer lower interest rates and better terms. Grants, on the other hand, are typically non-repayable and used for smaller-scale or early-phase research initiatives.

10. Are there international consequences to this decision?

Yes, the policy shift may weaken America’s leadership position in global climate talks. Allies in the EU and Asia are investing heavily in clean technology, and U.S. inconsistency can reduce trust. It may also open competitive gaps that foreign companies can exploit. Additionally, international investors may grow more cautious about funding U.S.-based green energy projects without strong federal support.