New York, NY – July 24, 2025 — The Dow Jones hits record high after U.S.–Japan tariff agreement, sending shockwaves through global markets and sparking renewed investor optimism in a time of economic unpredictability. The historic deal, announced late Tuesday, is being hailed as a significant diplomatic and economic milestone—one that has now translated into record-setting gains on Wall Street.

Trade Diplomacy Boosts Market Confidence

On Tuesday evening, the United States and Japan formally signed a long-anticipated tariff reduction agreement aimed at easing trade restrictions across several critical sectors, including automotive parts, semiconductors, heavy machinery, and green technologies. The deal follows months of closed-door negotiations and is seen as a major shift in bilateral trade policy.

The immediate market reaction was profound. By mid-Wednesday, the Dow Jones Industrial Average surged 1.73%, closing at an unprecedented 40,122.47—the highest in its 139-year history.

“Markets love certainty, and this agreement provides it,” said Lydia Greene, a senior economist at BridgePoint Capital. “The Dow’s performance today is not just about tariffs—it’s about a return to stability in one of the world’s most crucial economic corridors.”

Sector Winners: Who Benefited Most?

While the entire market trended upward, specific sectors stood out:

✅ Automotive & Heavy Machinery

Japanese automakers like Toyota and Honda saw U.S.-listed ADRs rise by over 3%, while U.S.-based manufacturers such as Caterpillar and Ford surged more than 4% on optimism surrounding reduced part import costs.

✅ Semiconductor & Tech Supply Chains

Chipmakers like Intel and NVIDIA posted gains as the tariff rollback includes advanced microchips—an area critical to both national security and global tech production.

✅ Green Technology

The deal also includes language around cooperation in clean energy—specifically EV battery components and hydrogen technology—leading to double-digit gains for Tesla and lesser-known players like Plug Power.

Global Implications Beyond the Dow

Economists and geopolitical analysts agree this agreement has implications far beyond Wall Street. The U.S.–Japan tariff accord is being viewed as a strategic counterbalance to growing trade tension with China and a move to solidify ties among democratic economies.

“Japan is America’s fourth-largest trading partner, and this deal is more than just about goods—it’s about influence,” said Dr. Marcus Han, Professor of Global Economics at Stanford University. “This could trigger a ripple effect with other Indo-Pacific economies reconsidering their tariff frameworks.”

The news comes just days before U.S.–EU trade negotiations ahead of Aug. 1 tariffs (source)—adding to the global momentum for more open and strategic economic alignments.

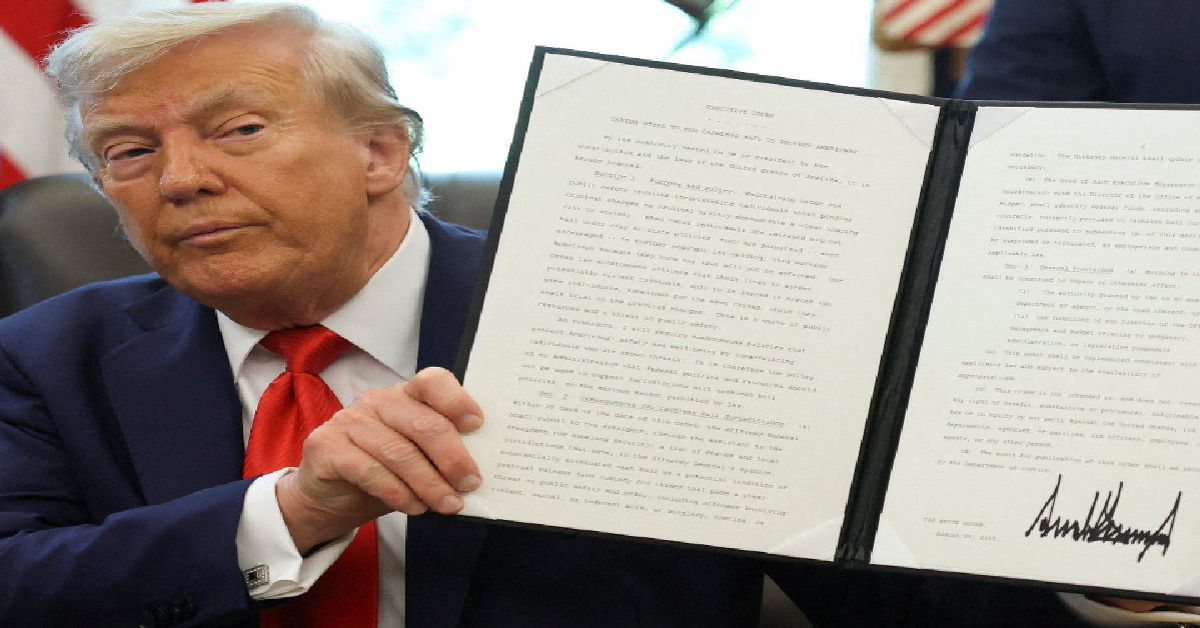

The Political Angle: Timely Moves Ahead of 2026 Midterms

In Washington, the agreement was quickly seized upon as a bipartisan victory. President Morgan and Japanese Prime Minister Hiroshi Tanaka held a joint press conference where both leaders touted the economic and diplomatic gains of the deal.

With the 2026 U.S. midterms looming, the administration is clearly leaning into economic wins to buoy approval ratings.

“This is a strong signal to voters and the markets that the U.S. is reclaiming its leadership in global trade,” said Ava Lewis, political editor at MarketWatch.

Additionally, the deal is expected to strengthen Japan’s domestic position ahead of its own general elections, reinforcing a political narrative of competence and global cooperation.

Economic Outlook: Can the Momentum Last?

Despite the euphoria, some analysts urge caution. The Dow’s record is impressive, but questions remain:

- Will these tariff reductions hold amid future political shifts?

- Can U.S. manufacturers scale fast enough to capitalize on new opportunities?

- How will China respond to deepening U.S.–Japan ties?

Still, in the short term, the economic outlook appears positive. The Federal Reserve has signaled a pause in rate hikes, inflation continues to decline, and consumer confidence is climbing.

A recent spike in tech and innovation optimism also contributed to market buoyancy, particularly after companies like Revo Technologies in Murray, Utah announced expansive R&D investments in automation and clean tech.

Market Reactions Worldwide

It wasn’t just the Dow that celebrated the news. Global indices responded with similar enthusiasm:

- Nikkei 225: +2.1%

- FTSE 100: +0.9%

- DAX (Germany): +1.3%

- S&P 500: +1.2%

- Nasdaq Composite: +1.6%

Currency markets also showed slight volatility as the yen strengthened against the dollar, reflecting renewed faith in Japan’s export-driven economy.

Conclusion

The Dow Jones hitting a record high following the U.S.–Japan tariff agreement is more than just a stock market milestone—it’s a signal of renewed confidence in global trade diplomacy. The deal reflects a strategic partnership between two of the world’s largest economies, poised to reduce costs, improve supply chains, and stimulate growth across multiple industries. Investors responded swiftly, with gains seen in tech, manufacturing, automotive, and green energy sectors.

Beyond the numbers, this agreement sets a powerful precedent for multilateral cooperation in an increasingly competitive geopolitical landscape. It also bolsters political capital for leaders in both Washington and Tokyo ahead of key elections. While short-term optimism is high, long-term success will depend on policy execution, industrial scalability, and sustained diplomatic alignment. Still, for now, markets are cheering what they see as a much-needed breakthrough.

The ripple effects of this move may soon influence other ongoing negotiations, particularly between the U.S. and EU. As investors watch closely, one thing is clear: the Dow’s rise is not just symbolic—it’s foundational. The world is witnessing a pivotal shift in global economic momentum.

FAQs

1. Why did the Dow Jones hit a record high after the U.S.–Japan tariff agreement?

The Dow Jones surged because investors reacted positively to the reduction in tariffs between two of the world’s largest economies. The agreement created a sense of stability and opportunity for industries such as automotive, semiconductors, and manufacturing. By reducing trade barriers, companies expect higher profitability and stronger cross-border collaboration. This optimism helped push the market to a record-setting close.

2. What industries benefit most from the U.S.–Japan tariff deal?

The sectors that stand to gain the most include automotive manufacturing, semiconductors, green energy, and heavy machinery. U.S. companies can now import Japanese components at a lower cost, improving production efficiency. Likewise, Japanese firms exporting to the U.S. are expected to gain market share. This mutual benefit is key to sustained industrial growth and investor confidence.

3. How will this trade agreement affect American consumers?

Consumers in the U.S. could see long-term benefits in the form of lower prices on imported goods, especially electronics and vehicles. The reduction in tariffs makes it cheaper for companies to bring in parts and products, which may lower retail prices. Additionally, increased competition can drive innovation and better quality. However, these effects may take a few months to materialize.

4. Is this agreement related to U.S.–China trade tensions?

Indirectly, yes. The U.S.–Japan agreement is part of a broader strategy to diversify trade partnerships and reduce reliance on China. By strengthening ties with Japan, the U.S. signals its intent to stabilize economic relationships with trusted allies. This move may also encourage other Asia-Pacific nations to negotiate similar agreements. It’s a strategic step in reshaping global trade alliances.

5. Could the Dow’s rise be temporary or is it sustainable?

While the initial spike is driven by positive sentiment, sustainability depends on follow-through in both economic and policy arenas. If the agreement leads to increased trade volume and stronger corporate earnings, then gains could continue. However, market corrections are always possible if global tensions rise or economic data turns negative. Long-term sustainability requires consistent progress and stable policy.

6. How does this deal impact U.S.–Japan diplomatic relations?

The agreement reinforces diplomatic trust and economic collaboration between the two nations. It shows that both sides are committed to resolving trade issues through negotiation rather than conflict. This strengthens the alliance not only economically but also politically and strategically, especially in the context of Indo-Pacific affairs. The deal is a milestone in their evolving bilateral relationship.

7. What role did tech companies play in this market rally?

Tech companies were major drivers of the rally, particularly those in the semiconductor and hardware space. Tariff reductions make it cheaper to source high-tech components from Japan, boosting profit margins. This deal is especially relevant as global demand for AI, chips, and EV technology continues to rise. As a result, tech stocks saw above-average gains on the announcement day.

8. Are there any risks associated with this tariff agreement?

While the agreement is largely positive, risks remain. Political shifts in either country could undo or revise the deal. Additionally, competitors—such as China or the EU—may react with their own economic maneuvers. Supply chain adjustments could also take time, which may temporarily impact certain sectors. Overall, while promising, the deal must be closely monitored for implementation challenges.

9. How might this agreement influence other global trade deals?

This U.S.–Japan agreement may serve as a blueprint for other bilateral or regional trade negotiations. Nations watching from the sidelines—like South Korea, Australia, and EU members—could pursue similar arrangements. It also adds pressure on stalled negotiations elsewhere to reach resolution. The success of this deal could inspire a new wave of cooperative economic diplomacy worldwide.

10. What should investors watch for in the coming weeks?

Investors should monitor earnings reports from key industries affected by the agreement to gauge its real-world impact. Developments in other trade negotiations, such as the ongoing U.S.–EU talks, will also be crucial. Additionally, changes in Fed policy or inflation data could influence market direction. Staying updated on corporate guidance and international responses will be key to making informed decisions.