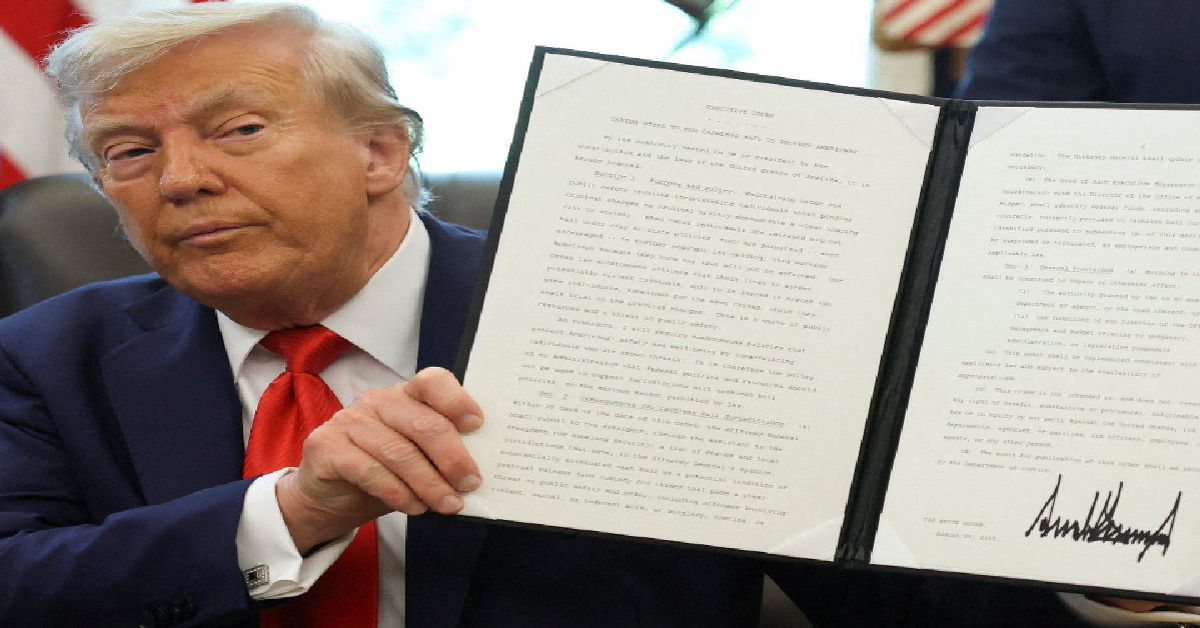

In a high-energy rally in Pittsburgh, President Donald Trump reignited his signature economic strategy by announcing a dramatic increase in tariffs on steel and aluminium imports. Speaking to a crowd filled with steelworkers, Trump declared that the current 25% tariff rate would be doubled to 50%, effective from Wednesday. The move, he claimed, would revitalize America’s steel industry, reduce foreign reliance, and reward workers who have long felt overlooked. As chants of “USA! USA!” echoed through the rally hall, Trump assured his base, “There will be no layoffs and no outsourcing whatsoever.”

Reviving US Steel: A Familiar Promise

This isn’t the first time Trump has made steel a cornerstone of his economic platform. Back in 2018, during his first term, he introduced a 25% tariff on steel imports, which he credited with saving US Steel America’s largest steel manufacturer headquartered in Pittsburgh. This time, the stakes appear higher. “At 50%, they can no longer get over the fence,” Trump said, alluding to foreign competitors. While he praised the company’s legacy, it’s no secret that US Steel has seen declining sales and profits in recent years, putting more pressure on government intervention to restore its market position.

Japan and the $14 Billion Deal

Adding to the surprise of the announcement was Trump’s mention of a $14 billion investment into local steel production. According to the president, this injection of funds will come through a new partnership between US Steel and Japan’s Nippon Steel. While this sounds promising for the region, especially for job security and modernization, Trump later admitted to reporters that he had not yet seen or approved the final deal. The vagueness around the agreement’s details raised questions among analysts and even steelworkers concerned about their union contracts and job protections under foreign involvement.

Domestic Industry vs Global Trade Reality

The U.S. has long struggled to maintain a competitive edge in steel production. Today, countries like China, India, and Japan dominate global steel manufacturing. A significant portion roughly 25% of the steel used in America is imported. Trump’s new tariff aims to curb this dependency, especially on imports from neighboring Mexico and Canada, which he criticized during his speech. However, critics argue that the higher tariffs could lead to increased costs for manufacturers and consumers, potentially causing ripple effects across the broader economy.

Bonuses and Blue-Collar Cheers

One of the most cheered moments during Trump’s speech was his pledge of a $5,000 bonus to every US steelworker. Framing it as a long-overdue reward, Trump positioned the bonus as a celebration of American labor. “Every steelworker deserves this. They’ve held up the economy on their shoulders,” he said. While the promise was met with thunderous applause, no specific funding details or timelines were provided. Union leaders have welcomed the spirit of the offer but say they’re cautiously optimistic until formal agreements are made.

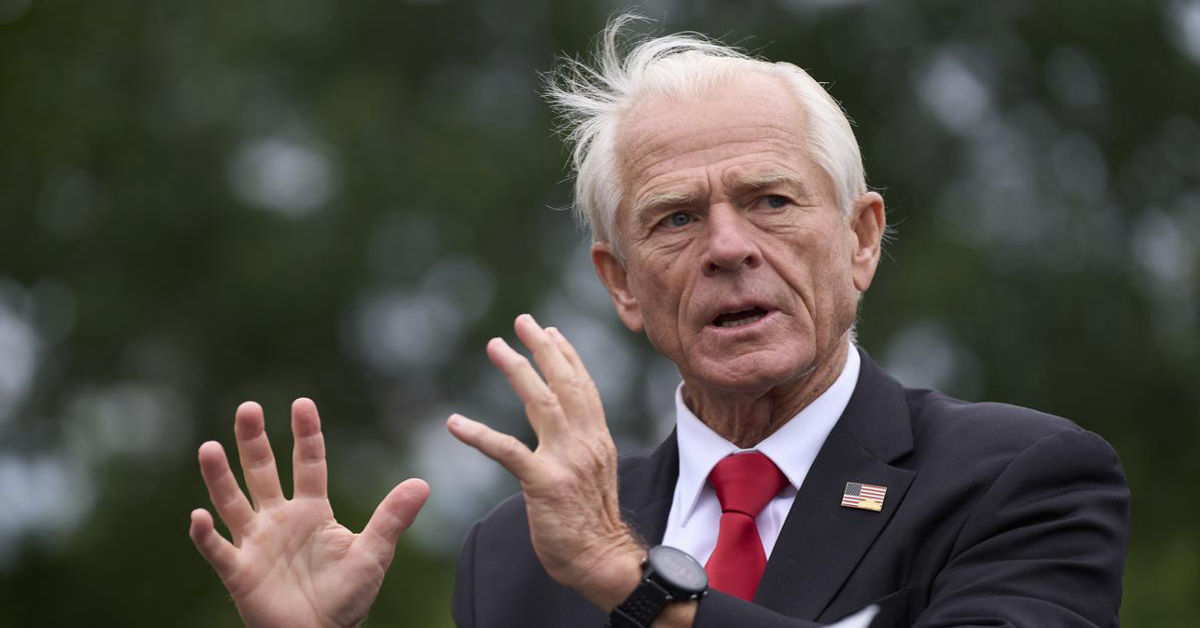

Legal Hurdles on the Horizon

Trump’s bold economic measures don’t come without opposition. His return to heavy tariff usage has sparked renewed legal challenges. Currently, a court battle is unfolding over the legality of his global tariffs, which were originally implemented during his first presidency. Although the Court of International Trade ordered the administration to halt certain tariffs. An appeals court has allowed the broader case to proceed. For now, Trump’s tariffs on steel and aluminium remain untouched by the lawsuits, giving him legal room to maneuver—at least temporarily.

Union Contracts and Worker Concerns

Among steelworkers, the new tariffs are a mixed bag. While many are hopeful about job security and economic uplift, there’s lingering concern about how foreign investors like Nippon Steel will respect existing labor agreements. Union leaders have expressed cautious support for the tariffs but want to ensure that any foreign partnership upholds their pay structures, hiring rules, and health benefits. People see Trump’s assurance that “no outsourcing whatsoever” will take place as a welcome gesture. But they still need policy backing and legal reinforcement to support it.

Economic Gamble or Strategic Genius?

Economists are split on the effectiveness of raising tariffs to such levels. Some argue that this is a calculated gamble to bring manufacturing jobs back to America, potentially spurring growth in struggling industrial regions. Others see it as an overreach that may prompt retaliation from trade partners or hurt American businesses that rely on imported materials. As the 2024 election dust settles and Trump takes bold steps to differentiate his second term. This tariff move may be one of his most significant economic plays yet.

Impact on American Manufacturing

Beyond steel, the ripple effects of the tariff increase could reach various sectors. Car manufacturers, construction companies, and machinery producers all rely on steel and aluminium for production. With the price of raw materials likely to rise, companies may pass those costs down to consumers. Small manufacturers, in particular, may struggle to absorb these increases, potentially leading to job cuts or reduced output. While Trump’s focus remains on the steel industry, the broader implications for U.S. manufacturing are still unfolding.

Conclusion

President Trump’s decision to double tariffs on steel and aluminium to 50% marks a defining moment in his second term. It reflects a deeper commitment to reshoring American industry, protecting domestic jobs, and challenging the global status quo. While the announcement has energized his supporters, especially in Rust Belt states like Pennsylvania, its long-term success will depend on several factors legal sustainability, international response, and how well domestic industries adapt. It remains to be seen whether people will view this move as economic protectionism or industrial salvation. But it has undeniably returned steel to the heart of American politics.