As the August 1 deadline for proposed U.S. tariffs on European goods draws closer, diplomatic efforts between Washington and Brussels have reached a fever pitch. Both sides are navigating a fragile path, attempting to avoid a potentially damaging trade conflict that could impact billions in transatlantic commerce.

With clockwork urgency, the EU is racing to secure a U.S. trade deal, pushing forward proposals aimed at neutralizing long-standing disputes over digital taxation, agricultural trade, and green energy subsidies. Yet behind closed doors, officials on both continents are quietly preparing for the worst — a full-fledged tariff war that could disrupt global markets and further strain diplomatic ties.

A Tipping Point in Transatlantic Trade Relations

The strain has been building for months. Following years of friction over tech regulations, carbon tariffs, and accusations of protectionism, the Biden administration issued a stern warning in May: unless meaningful progress is made on structural trade imbalances, the U.S. would impose retaliatory tariffs starting August 1.

At risk are over $80 billion in goods, ranging from European dairy and wine to U.S.-bound industrial machinery and automotive parts. The threatened tariffs are not just punitive—they are symbolic of deeper frustrations over Europe’s trade policies, which some American lawmakers say unfairly disadvantage U.S. firms.

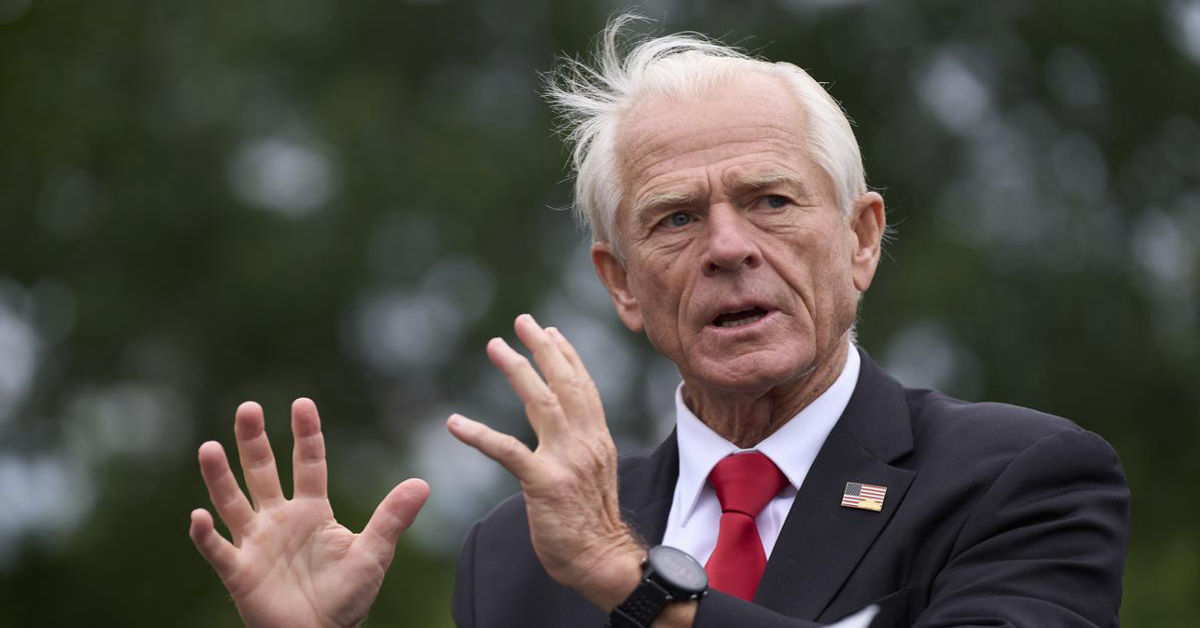

“The U.S. cannot continue to tolerate imbalanced market access and regulatory barriers under the guise of sovereignty or environmental policy,” a senior U.S. trade representative stated anonymously last week.

The EU’s Dual Strategy: Negotiate and Brace

Publicly, the European Commission insists that a negotiated outcome is still possible. A revised proposal has already been submitted that would overhaul aspects of the controversial digital services tax, a key U.S. grievance. The plan would also enhance bilateral cooperation on AI regulation and green innovation funding, areas of strategic interest to both economies.

But behind the scenes, EU officials are bracing for disruption. Contingency measures are being drafted at the national level, especially among major export economies like Germany, France, and Italy. These include:

- Emergency subsidies for affected sectors

- Strategic redirection of exports to Asia-Pacific markets

- Legal challenges at the World Trade Organization (WTO)

“We are seeking resolution, but we are also preparing for every eventuality,” said Margrethe Vestager, Executive Vice President of the European Commission, during a press briefing in Brussels.

Key Disputes: More Than Just Tariffs

The roots of the standoff go beyond tariffs. The conflict centers on philosophical and regulatory differences between two of the world’s largest economies:

🔹 Digital Economy & Taxation

The EU’s attempts to tax large U.S. tech firms through national and bloc-wide digital services taxes have sparked fierce opposition from Washington. The U.S. argues that such taxes disproportionately target American businesses, while the EU contends they are a necessary measure to ensure fair taxation in the digital age.

Emerging technology trends and the fast-paced evolution of AI governance have only added complexity to the issue.

🔹 Agricultural Policy & Food Standards

The U.S. wants broader access to European markets for genetically modified crops and hormone-treated beef products that face heavy resistance under EU food safety laws. Europe’s agricultural lobby remains a powerful force, limiting negotiators’ flexibility.

🔹 Green Subsidies & Carbon Tariffs

Both sides are pursuing aggressive climate agendas, but the Inflation Reduction Act and the EU’s Carbon Border Adjustment Mechanism (CBAM) have triggered accusations of unfair subsidies and disguised protectionism.

Global Implications and Market Volatility

The potential fallout extends far beyond Brussels and Washington. A failure to reach an agreement could have cascading effects on:

- Global supply chains, already strained by post-pandemic adjustments

- Commodity prices, especially in food and industrial metals

- Stock market confidence, particularly in sectors reliant on exports

European companies have already started adjusting forecasts. Automotive suppliers, aerospace manufacturers, and agribusiness exporters report increased hedging activity and lower Q3 growth estimates.

For consumers, the trade rift could mean higher prices on imported goods, especially in electronics, wine, dairy, and luxury vehicles.

Washington’s Domestic Calculus

With the U.S. presidential election less than 16 months away, domestic politics are heavily influencing Washington’s trade posture. Appeasing labor unions and revitalizing American manufacturing remain top priorities for the Biden administration, particularly in battleground states like Pennsylvania, Michigan, and Wisconsin.

“Tough on trade resonates well in Rust Belt districts,” notes Dr. Erin Wallace, a senior trade analyst at the Brookings Institution. “But the White House has to walk a tightrope—assertiveness must not morph into economic self-harm.”

What Happens if No Deal Is Reached?

Should the August 1 deadline pass without a breakthrough, the following scenarios are likely:

- Immediate U.S. Tariffs on targeted European imports.

- EU Retaliation, possibly through counter-tariffs or expedited regulatory scrutiny of U.S. tech firms.

- WTO Arbitration, which could take years to resolve.

- Currency and market instability, particularly in sectors dependent on transatlantic trade.

For European citizens and American consumers alike, these consequences could mirror the volatility seen in other flashpoints of economic and social disruption. Historical examples of civil unrest suggest that public sentiment can shift rapidly when livelihoods are at stake.

Conclusion

As the clock ticks down to the August 1 tariff deadline, both Washington and Brussels are navigating one of the most consequential trade negotiations in recent memory. The urgency with which the EU is racing to secure a U.S. trade deal reflects not just economic necessity but political pressure on both sides. With billions in trade at stake, the implications of a failed agreement could ripple through supply chains, financial markets, and everyday consumer prices. Behind diplomatic smiles lie growing concerns, especially as Brussels discreetly prepares for the worst-case scenario.

The core issues—digital taxation, agricultural standards, and green subsidies—represent deep-rooted philosophical divides that won’t be resolved overnight. If these talks collapse, businesses across the Atlantic may face immediate disruptions and long-term uncertainty. Investors are already bracing for volatility, while industry leaders call for clarity and compromise. Yet, with elections looming and domestic politics shaping negotiation strategies, the path to resolution remains murky.

Whether August 1 marks the start of a renewed partnership or a descent into tariff warfare will soon become clear. One thing is certain: global trade watchers will be paying very close attention.

FAQs

1. Why are the U.S. and EU currently in trade negotiations?

The U.S. and EU are in negotiations due to rising tensions over trade imbalances, digital taxation, agricultural standards, and environmental subsidies. With the U.S. threatening to impose new tariffs by August 1, both sides are working to prevent a repeat of past trade conflicts. The aim is to establish a fairer and more balanced framework for transatlantic commerce that benefits both economies.

2. What goods are at risk if the August 1 tariffs take effect?

Goods potentially affected by the tariffs include European wine, cheese, cars, and industrial machinery, as well as American agricultural exports and tech components. The new tariffs could impact over $80 billion in transatlantic trade, with industries like automotive, aerospace, and digital services being hit the hardest. This would lead to higher prices for both businesses and consumers.

3. Why is the EU racing to secure a U.S. trade deal?

The EU is urgently working to reach a trade agreement to avoid economic disruption and maintain stability across key export sectors. European officials recognize that without a deal, the repercussions could harm EU manufacturers, agricultural exporters, and tech companies. Securing the deal would also reinforce diplomatic relations and protect against further fragmentation of global trade norms.

4. What are the main sticking points in the negotiations?

The primary points of contention include the EU’s digital services taxes, U.S. demands for agricultural market access, and green subsidy programs perceived as protectionist. Disagreements also persist over regulatory standards for tech, food safety, and intellectual property. These are deeply rooted issues tied to national sovereignty and economic strategy, making resolution complex and politically sensitive.

5. How are businesses preparing for potential tariffs?

Businesses on both sides are developing contingency plans, including adjusting supply chains, diversifying export markets, and hedging against currency fluctuations. Some companies are stockpiling goods ahead of the deadline, while others are lobbying their governments to push for a last-minute compromise. Uncertainty around the tariffs is already affecting investment decisions and long-term planning.

6. Could the August 1 tariffs lead to a trade war?

Yes, if no agreement is reached and tariffs are implemented, it could escalate into a broader trade war between the U.S. and EU. Such a conflict would likely result in retaliatory tariffs, legal battles in the WTO, and increased volatility in global markets. A trade war could also undermine international cooperation on climate, security, and innovation policies.

7. What impact would the tariffs have on consumers?

Consumers would likely face higher prices on imported goods such as European luxury cars, wine, dairy products, and electronics. U.S. goods exported to the EU could also become more expensive due to retaliatory tariffs. Inflationary pressure may rise in certain sectors, especially those reliant on imported raw materials or components from across the Atlantic.

8. What happens if a deal is reached before August 1?

If a trade deal is secured in time, both sides will likely roll back tariff threats and announce a framework for ongoing cooperation. This could include revisions to the EU’s digital tax policies, joint initiatives on green innovation, and more structured dispute resolution mechanisms. It would also signal market stability and boost investor confidence in the transatlantic economy.

9. Why is digital taxation such a major issue?

Digital taxation is controversial because the EU’s policies disproportionately affect large U.S. tech firms like Google, Amazon, and Meta. The U.S. sees these taxes as unfair trade barriers, while the EU argues that global digital firms must pay their fair share of taxes where they operate. Resolving this issue requires balancing tax equity with international trade norms and tech regulation.

10. How can this situation affect global markets?

Global markets are sensitive to trade disruptions between major economies like the U.S. and EU. A breakdown in negotiations could lead to stock market volatility, currency fluctuations, and reduced investor confidence. Sectors such as manufacturing, agriculture, and technology could experience delays, shortages, or reduced exports, ultimately slowing global economic growth and recovery efforts.